SUPPORT & RECOVERY FOCUSED BENEFITS

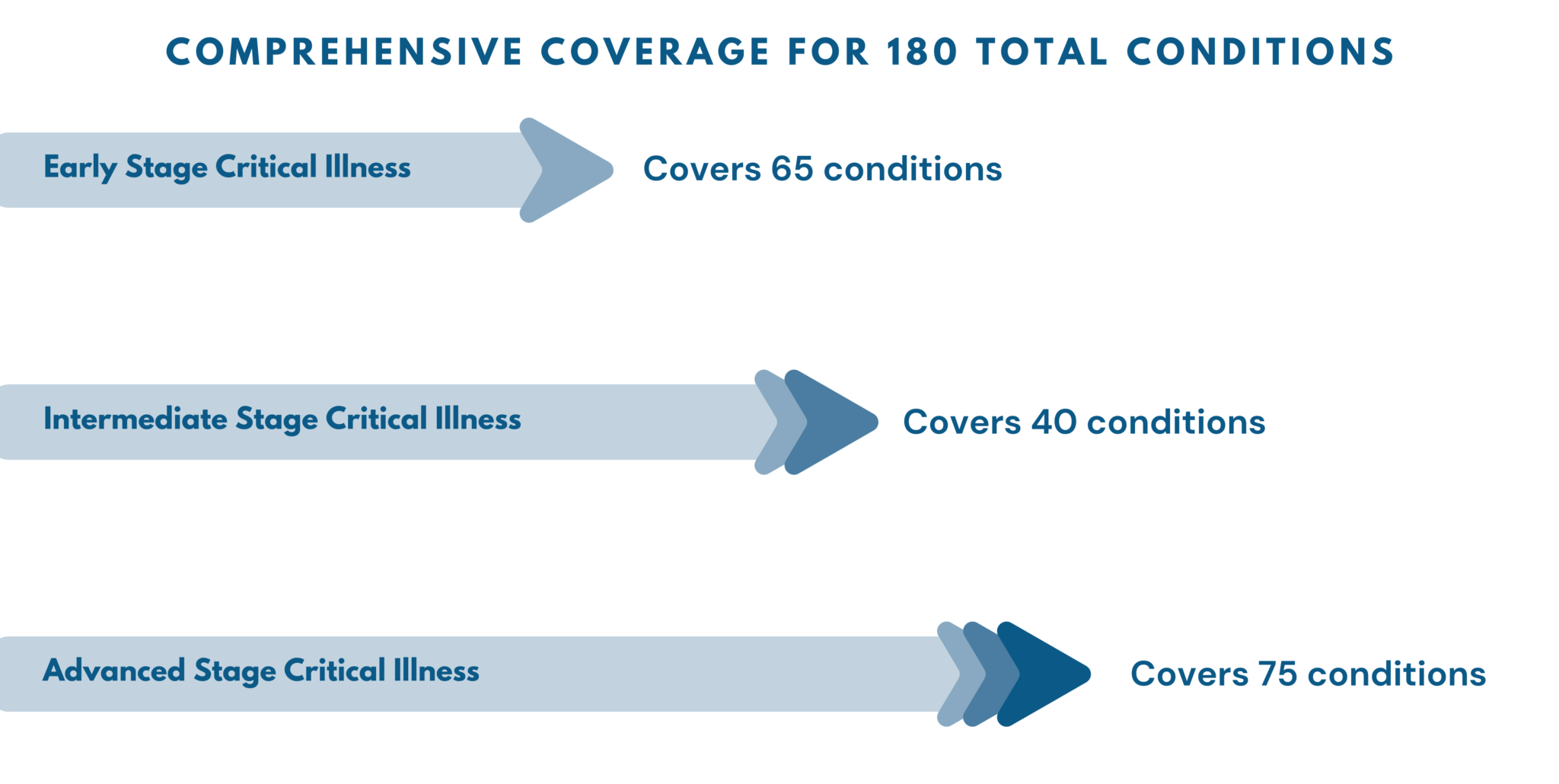

Receive coverage of up to 180 conditions

Receive up to 5% of Basic Sum Assured

Receive up to RM600 applicable for SA of RM100K and above

Receive Personal Medical Case Management service for ease of healthcare access

Receive Personal Medical Case Management service for ease of healthcare access

Receive up to 10% of sum assured

Frequently Asked Questions

The CI Shield+ is a plan underwritten by AIA Bhd Malaysia, product name known as A Life Beyond Critical Care.

The CI Shield+ plan provides critical illness coverage until age 80 under a non-participating plan. It covers 180 conditions, divided into 65 Early Stage, 40 Intermediate Stage, and 75 Advanced Stage Critical Illnesses. Along with this extensive coverage, the plan offers Health Management Benefits, a Yearly Cash Bonus, Personal Medical Case Management, a Guaranteed Maturity Benefit, and a Compassionate Benefit

The plan is available to individuals aged between 16 to 60 years old.

The plan covers you until the age of 80.

The minimum coverage amount for the plan is RM20,000.

The premium rates are level and based on your age when the plan is issued.

The premium rates are not guaranteed throughout the life of the plan. The insurance company reserves the right to revise the premium rates by giving the policyholders 3 months written notice.

Yes they are; up to RM 3,000 based on the guidelines provided by LHDN as of 2024 for Takaful and Life Insurance products.

The major exclusions of the plan include:-

- Any illness or surgery other than a diagnosis of, or surgery for, a specified Critical Illness Event;

- Any signs or symptoms of a Critical Illness Event defined as Advanced Stage manifesting either:

- a) within sixty (60) days from the policy’s Issue Date or Commencement Date (whichever is later) for Cancer, Heart Attack, Coronary Artery Bypass Surgery, Severe Coronary Artery Disease, or Angioplasty and other invasive coronary procedures; or

- b) within thirty (30) days from the policy’s Issue Date or Commencement Date (whichever is later) for all other Critical Illness Events under Advanced Stage;

- Signs or symptoms of a Critical Illness Event defined under Early or Intermediate Stage appearing within sixty (60) days from the policy’s Issue Date or

Commencement Date, whichever is later;

- A Critical Illness Event resulting directly or indirectly from a Pre-Existing Condition, as defined, that existed before the Issue Date or Commencement Date of the policy, whichever is later;

- A Critical Illness Event occurring in the presence of any Acquired Immune Deficiency Syndrome (AIDS) or Human Immunodeficiency Virus (HIV) infection. We may require the Insured to undergo an HIV test as a condition for accepting any claim, except in cases where Full-blown AIDS, HIV infection due to assault, HIV infection from blood transfusion, HIV infection due to organ transplant, or occupationally acquired HIV infection are involved, as defined by the policy.

- Any Critical Illness Event diagnosed or occurring due to a congenital defect or disease that was manifested or diagnosed before the Insured reached seventeen (17) years of age;

- Any Critical Illness Event resulting from a self-inflicted injury;

- Any Critical Illness Event directly caused by alcohol or drug abuse;

- Any case where the Insured did not survive for at least fifteen (15) days following the diagnosis of a Critical Illness Event.