FEMALE FOCUSED BENEFITS

Protection against life’s uncertainties or total permanent disability.

Protection against female critical illnesses, such as breast, cervical, and ovarian cancers from early stage onwards.

Protection for pregnancy related complications and uncertainties such as miscarriage and ectopic pregnancy.

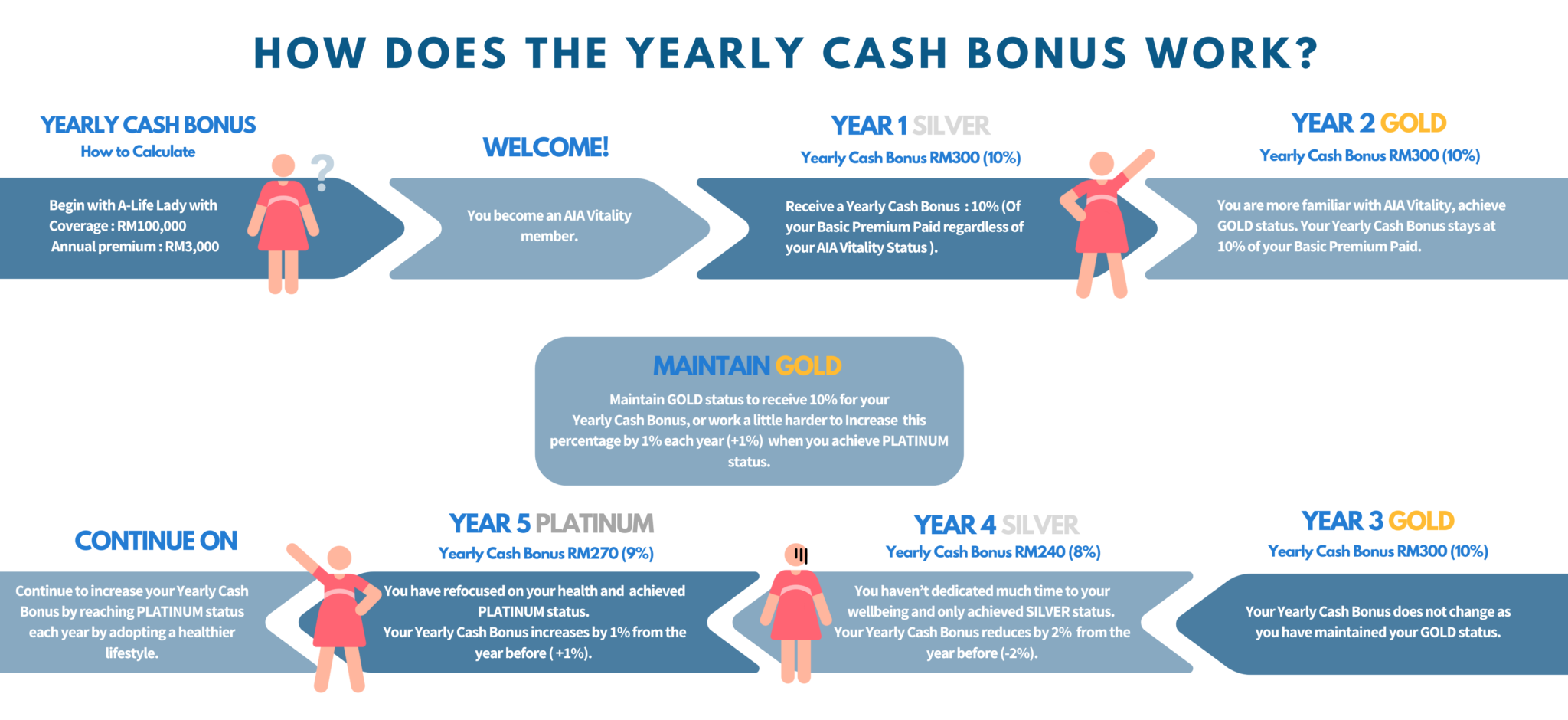

Receive an annual cash bonus based on your AIA Vitality Status, with up to 50% of your basic premium paid back each year!

Receive 150% of coverage amount at plan maturity when you reach 80 years of age.

Get up to 3% Cash Reward when you insure a Prenatal Coverage for your baby!

No Medical Underwriting required when you insure a Prenatal Policy for your baby when your pregnancy is under 14 gestational weeks!

Frequently Asked Questions

Her Care is an insurance plan tailored for women, offering protection against female-related health issues and basic coverage for death and TPD until age 80. The plan includes distinct benefits, from Female Illness to Cash Rewards, along with a Maturity Benefit. AIA Vitality members also enjoy a Yearly Cash Bonus based on premium payments and Vitality status, with potential growth each year (up to 50% of your premium).

The plan is available to women aged 16 to 45 years old.

The plan provides coverage until the age of 80.

The minimum coverage amount is RM50,000.

The premium rates are consistent and will be calculated based on the age when the plan is issued.

The premium rates are not guaranteed throughout the life of the plan. The insurance company reserves the right to revise the premium rates by giving the policyholders 3 months written notice.

Yes it is; up to RM 3,000 based on the guidelines provided by LHDN as of 2024 for Takaful and Life Insurance products.

This plan does not provide coverage for:-

- Pre-existing conditions.

- Diseases directly or indirectly caused by Acquired Immune Deficiency Syndrome (AIDS) or Human Immunodeficiency Virus (HIV), except when HIV infection is due to blood transfusion. A blood test for HIV may be required before any claims are accepted.

- Self-inflicted injuries, whether sane or insane.

- Any signs or symptoms of covered conditions that first appear during the waiting period, including those leading to surgery. In case of disagreement between the insured and the physician, the physician’s opinion will prevail.